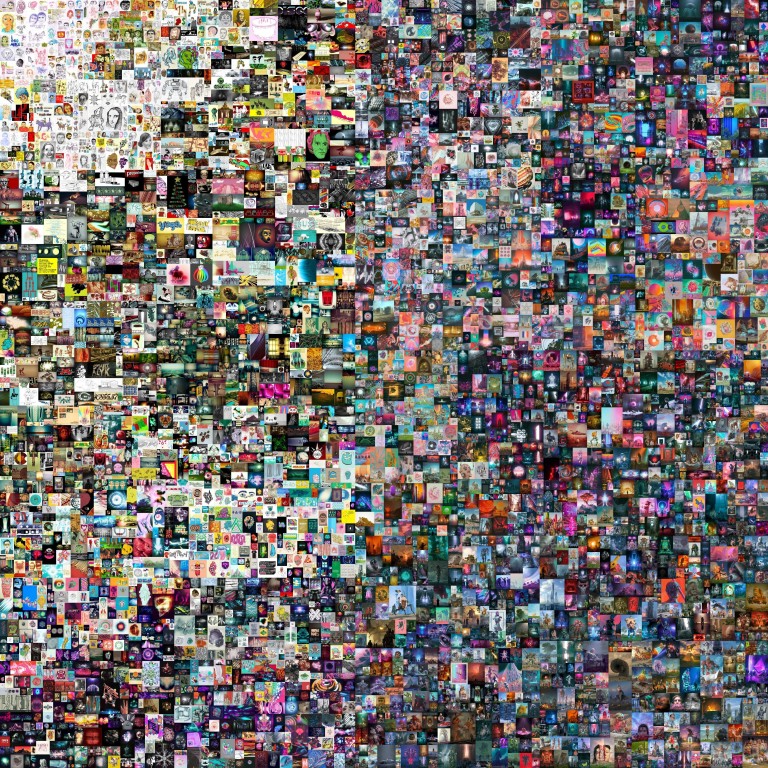

Non-fungible tokens and digital art: game-changers for Asian collectors or just another bubble?

- From Beeple’s US$69 million JPEG to Jack Dorsey’s first tweet, eye-watering auction prices for NFT creations have made the arts scene sit up and take notice

- Fans say art history is being made, with the new tech tilting the balance of power between East and West. Sceptics say buyers simply have too much money

In a post revealing his identity in the online newsletter Substack, Vignesh explained that the typical “palette” of investors, financiers and patrons of arts tended to be “monochrome”. By winning the landmark artwork, he was adding a “dash of mahogany”.

“The point was to show Indians and people of colour that they too could be patrons, that cryptocurrency was an equalising power between the West and the Rest, and that the global south was rising,” Vignesh said.

So what exactly is an NFT, why the buzz and is their rise the start of a new wave of art investment?

Just like the original painting of the Mona Lisa by Leonardo da Vinci is more valuable than copies or duplicates, NFTs are virtual assets that (thanks to the blockchain) are also distinguishable from copies or duplicates. This concept has led to individuals being able to sell digital artworks and other collectibles and trade them as assets, safe in the knowledge they are selling or buying an original piece.

NFTs have come to the fore in recent months as artists around the world have made millions by auctioning pieces of work as non-fungible tokens.

Forget bitcoin, this Singapore firm is using blockchain to build a city

Lawrence Loh, an associate professor of business at the National University of Singapore, agreed with Vignesh that the decentralised nature of cryptocurrencies could tilt the balance of power between institutions and individuals.

He cited how fiat – or normal – currencies are controlled by a central bank or an authority that issues the money, which means that its value is dependent on the institution.

Conversely, in cryptocurrency, because of the “intrinsic nature” of its blockchain technology, and how it is peer-to-peer distributed, there is no central authority. The same is true of NFTs, which use the same technology.

“Traditional financial institutions are usually from the West while many wealthy individuals are now from Asia,” said Loh.

“There is a thinking that the NFTs may empower these individuals to be less dependent on the institutions, thus equalising the power between the West and the rest.”

He suggested that NFTs could expand the range of assets available to Asian buyers. Loh said that while Asians were perhaps less appreciative than Westerners of traditional forms of art, “digital art might be something new for them to look into”.

Herman Salleh, director of H.arts Collective, an art advisory and management firm, said most of his art patrons were Westerners, possibly because they were more “culturally inclined” to collect traditional pieces.

“But [the number of] Asian collectors is growing … you would be surprised,” he said.

Loh, the business professor, said NFTs could be a game changer for the arts scene in Asia. He said there was a “very strong” trend of conspicuous consumption in the region, as wealthy Asian families bought collectibles to flaunt their wealth.

“It is very prevalent in Asia,” he said. “Basically, when you are buying something digital, you are just buying some bragging rights.”

Basically, when you are buying something digital, you are just buying some bragging rights

Businesspeople were also buying virtual art for the “thrill” of it, he said, adding that in the case of Vignesh – – the purchase was to feed some form of self-validation of his foray into cryptocurrencies.

Similarly, Bowie Lau, founder of angel investment firm MaGEHold, which has investments in the blockchain sector, said that with Asia’s fast pace of wealth growth, interest and participation in new tech innovations NFTs would increasingly be dominated by Asian buyers.

“Further, the familial culture often motivates Asians to accumulate wealth for posterity and unique and exquisite artworks are great pieces of wealth that could be handed down from one generation to another,” she added.

Lau said NFTs had allowed a “new liberalisation of art” that was not previously possible with physical art ownership.

She pointed out that physical art was mostly about possession by the owner; pieces were often kept away from public view or occasionally displayed in art museums. NFTs on the other hand were publicly verifiable and were “freely viewable and downloadable by anyone”.

“The underlying powerful libertarian concept is that art should be free for all to view and enjoy but the bragging rights of ownership can still be exercised by whoever owns the NFT associated with that art,” she said. “NFTs have become a more convenient asset for people to invest in and be able to sell conveniently at prices discovered transparently in marketplaces.”

Already, artists and art galleries in Asia are pinning their hopes on NFTs being the next big thing. Marc Yap, a 25-year-old arts undergraduate in Singapore, said the recent NFT trend was the “way of the future”, pointing to how there was always a demand for digital art.

How bitcoin went from Wall Street to the high streets of Southeast Asia

Yap, a traditional artist initially, felt artists in the region could benefit from the trend as a new channel of passive income. Vignesh also hinted at this in an interview with Singapore media, saying: “Artists should use this situation and understand that this shift is for them.”

Even so, Troy Sadler, managing director of Singapore-based art gallery Art Works, felt digital art could never replace traditional mediums like oil on canvas and sculpture, in the same way electronic music could never replace guitars.

“It will just be another medium. It will be interesting to see this medium and market evolve especially in terms of provenance and potentially ongoing royalties for artists,” he added.

Asked if there was a possibility that physical art museums and galleries could keep up with the trend and branch into virtual spaces for the display and selling of digital art, he said his firm had no current plans but added that one artist he worked with had just released his first NFT this week.

Let’s not pretend this serves any social goals

Not everyone is impressed by the rise of NFTs. Antonio Fatas, professor of economics at Insead, said there was “nothing equalising” about NFTs, and that people who bought them had “too much money”.

He said artists needed proper channels of distribution to be able to share their work with others and NFTs did not let them do this.

“This is a platform to create copies of digital art and attach them to a non-obvious certificate of originality,” he said, adding the market was fuelled by speculation and hype.

“If people want to pay for these digital objects, let them do it but let’s not pretend that this serves any social goals.”

David Lee, a finance professor at the Singapore University of Social Sciences’ Business School, said this was just the beginning of an experimentation with digital arts, tweets and videos.

Eventually, he said, other physical assets would be tokenised.

There would always be critics, he said, but when people recognised the use of NFTs they would be converted. Millennials would be particularly receptive.

Said Lee: “The hype cycle is a normal and necessary function of the market to weed out weak ideas, and NFTs are no exception.

“Every investment class is in a bubble now.”